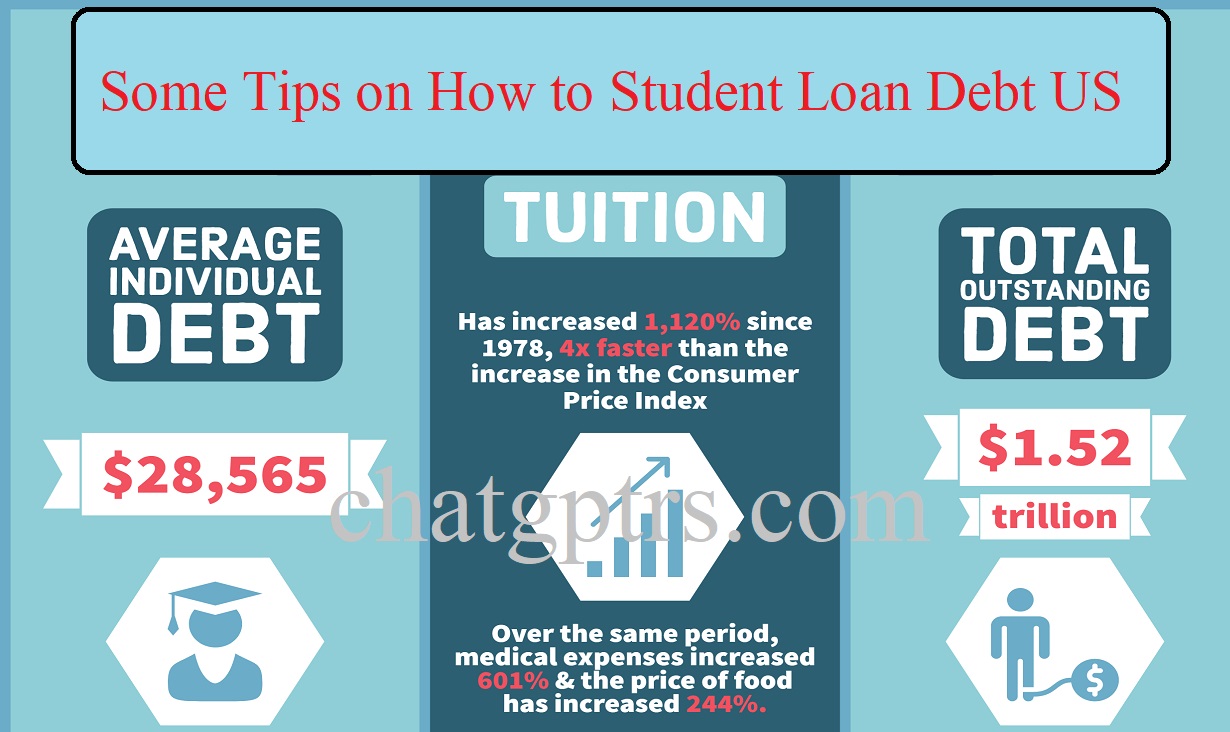

Student loan debt is a major financial burden for many Americans. The average student loan borrower in the United States owes over $30,000. This debt can make it difficult to save for retirement, buy a home, or start a business. Here are Some Tips on How to Student Loan Debt US.

How to Student Loan Debt US

There are a number of strategies that you can use to pay off your student loan debt. The best strategy for you will depend on your individual circumstances, such as your income, expenses, and debt load.

Here are some tips on how to pay off student loan debt:

- Make a budget and track your spending: This will help you to see where your money is going and make sure that you are not overspending.

- Increase your income: This could mean getting a part-time job, starting a side hustle, or asking for a raise at work.

- Pay more than the minimum payment: This will help you to pay off your debt faster and save money on interest.

- Consider consolidating your loans: This can make it easier to manage your payments and get a lower interest rate.

- Look for repayment assistance programs: There are a number of government and private programs that can help you to repay your student loans.

- Don’t give up: Paying off student loan debt can be a long and challenging process, but it is definitely possible.

The Basics of Student Loan Debt

- Student loan debt is money borrowed to pay for education.

- The average student loan borrower in the United States owes over $30,000.

- Student loan debt can make it difficult to save for retirement, buy a home, or start a business.

Helpful Tips to do so:

Here are some additional tips that you may find helpful:

- Make a plan: The first step to paying off your student loan debt is to create a plan. This plan should include your current debt balance, your monthly income and expenses, and your desired repayment timeline.

- Be realistic: When creating your plan, it is important to be realistic about your income and expenses. Don’t try to set a repayment goal that is unrealistic, or you may end up discouraged and give up.

- Be patient: Paying off student loan debt takes time and effort. Don’t get discouraged if you don’t see results immediately. Just keep at it, and you will eventually reach your goal.

Strategies for Paying Off Student Loan Debt

- Make a budget and track your spending.

- Increase your income.

- Pay more than the minimum payment.

- Consider consolidating your loans.

- Look for repayment assistance programs.

- Don’t give up.

Making a Budget and Tracking Your Spending

- The first step to paying off your student loan debt is to create a budget. This will help you to see where your money is going and make sure that you are not overspending.

- There are a number of budgeting tools available online and in apps.

- Once you have created a budget, track your spending for a month or two to make sure that you are sticking to it.

Increasing Your Income

- If you are struggling to make your student loan payments, consider increasing your income. This could mean getting a part-time job, starting a side hustle, or asking for a raise at work.

- There are also a number of government programs that can help you to increase your income, such as the Earned Income Tax Credit (EITC).

Paying More Than the Minimum Payment

- The minimum payment on your student loans is the lowest amount that you can pay each month without incurring late fees or penalties.

- However, paying more than the minimum payment will help you to pay off your debt faster and save money on interest.

- If you can afford to, try to pay an extra $100 or $200 each month towards your student loans.

Consolidating Your Loans

- Consolidating your student loans means combining them into one loan with a single monthly payment.

- This can make it easier to manage your payments and get a lower interest rate.

- However, there are some drawbacks to consolidating your loans, such as losing some flexibility in your repayment options.

Looking for Repayment Assistance Programs

- There are a number of government and private programs that can help you to repay your student loans.

- These programs may offer lower interest rates, deferred payments, or loan forgiveness.

- To find out if you qualify for any repayment assistance programs, visit the website of the U.S. Department of Education.

Don’t Give Up

- Paying off student loan debt can be a long and challenging process, but it is definitely possible.

- Don’t give up if you don’t see results immediately. Just keep at it, and you will eventually reach your goal.

FAQ on How to Pay Student Loan:

Here are some FAQs about paying off student loan debt:

How long does it take to pay off student loan debt?

The time it takes to pay off student loan debt will vary depending on your debt balance, your monthly income and expenses, and your repayment plan. However, it is generally recommended to pay off your student loans as quickly as possible.

What is the best way to pay off student loan debt?

The best way to pay off student loan debt will vary depending on your individual circumstances. However, some general tips include making more than the minimum payment, consolidating your loans, and taking advantage of repayment assistance programs.

What are some repayment assistance programs?

There are a number of government and private repayment assistance programs available to help borrowers pay off their student loans. Some of these programs include income-driven repayment plans, loan forgiveness programs, and deferment and forbearance programs.